We Thrive On Challenges

Strong Legal Advocate In Macon, Georgia

A Local Firm With Regional Scope

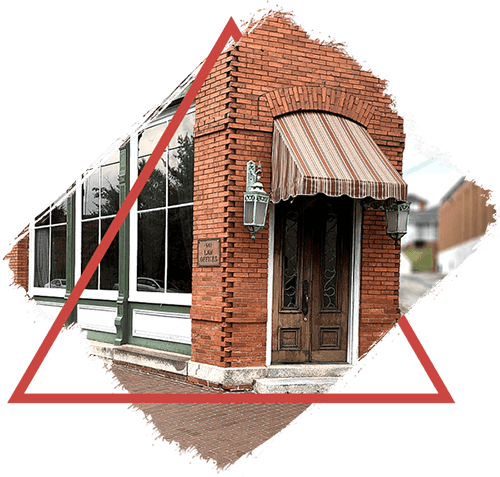

Located in Macon, Georgia, our reputation has traveled far beyond our community. Our clients come to us from all over Georgia and parts of Florida due to our ability to efficiently and effectively resolve business law, real estate law and estate concerns. We also help clients located in other states who have legal business in Georgia, such as those selling real estate.

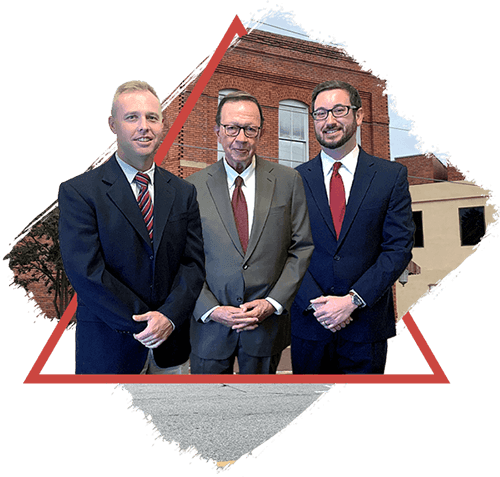

Meet Our Attorneys

In Memoriam J. Wayne Crowley

John Wayne Crowley, 74, went to be with his Lord and Savior on Monday, March 15, 2021. He will never be forgotten and will be missed terribly by all who knew him. He was not only a great attorney, but a great person. He always had a kind word for everyone and we all benefited from his wisdom… Discover More

J. Wayne Crowley

FEB. 22, 1947 – MAR. 15, 2021

Confident Trial Attorneys With Impeccable Records

Our law firm is in the building that used to house Capricorn Records, a label that put out music from some of our area’s most successful musical artists. Today, we strive to make this building known as a place you can come for help with your most vexing legal issues.